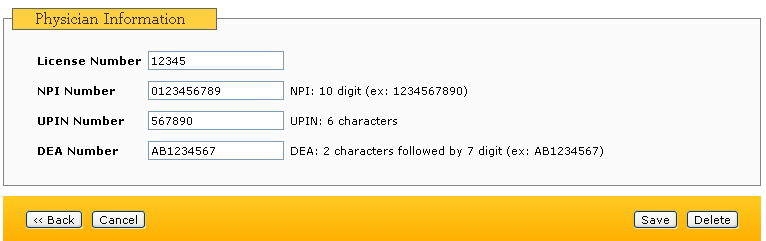

The Wisconsin Identity Protection PIN is different from the IRS’s Identity Protection (IP) PIN and cannot be used on your federal return.

Using My Tax Account for Personal Users Common Questions for assistance with creating your MTA and adding access to your personal accounts If you do not have MTA or do not have access to your individual income tax or homestead credit account in MTA, see.Our online application is secure and mobile-friendly.Follow these steps to sign up for a Wisconsin Identity Protection PIN: In minutes you will be connected with one of our mortgage experts. The home-buying process doesn’t have to be complicated and our team of mortgage professionals will help guide you through the financing process, answer your questions and keep you on track so you can achieve your home ownership goal. If you’re looking for a mortgage that will work with your budget, ask your mortgage loan officer if you qualify for a HOPP/ITIN home loan.Īt Prosperity Bank, we are redefining the home lending experience by offering loan options tailored to the needs of unique home buyers. SUBMIT A HOPP INQUIRY TODAY! Selecting a HOPP/ITIN Home Loan

An ITIN is available through the IRS regardless of your immigration status in the U.S. You may have an ITIN number if you are a non-resident alien filing a tax return and are not eligible to receive a Social Security number, or if you are a dependent or spouse of a non-resident alien visa holder. This program is designed for ITIN holders and other non-US residents with a valid SSN to achieve the American dream of homeownership. Owning a home is one of the cornerstones of the American dream, and we are making this dream a reality with our HOPP/ITIN home loan. Limitless Possibilities own the home of your dreams The Prosperity Bank Difference working with you every step of the way HOPP/ITIN - A Home Loan Program Helping BorrowersĬustomized Solutions for unique lending situations

0 kommentar(er)

0 kommentar(er)